BTC Price Prediction: 2025-2040 Outlook Amid Volatility and Institutional Adoption

#BTC

- Technical Outlook: Short-term bearish pressure (below 20MA) masks strong accumulation signals near $112K support.

- Macro Drivers: Institutional adoption (Tether, Matrixport) battles Fed policy uncertainty and weak jobs data.

- Long-Term Bull Case: Bitcoin's hardening as a reserve asset and yield generator supports multi-cycle appreciation.

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish Pressure Amid Long-Term Bullish Signals

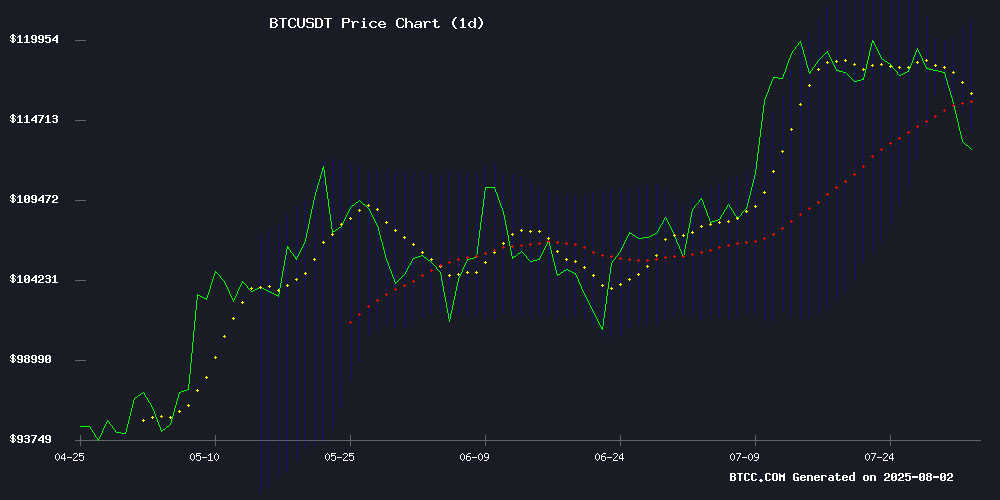

As of August 2, 2025, BTC trades at, below its 20-day moving average (117,724.54), signaling short-term bearish momentum. The MACD histogram (2,015.66) shows bullish divergence, but negative momentum (-1,282.43) persists. Bollinger Bands indicate volatility contraction, with price testing the lower band (114,363.47).notes BTCC analyst Olivia.

Market Sentiment: Institutional Adoption Clashes With Macroeconomic Fears

Conflicting narratives dominate headlines: While Tether's record profits and Canaan's BTC reserve adoption reflect institutional confidence, weak U.S. jobs data and Fed rate uncertainty create headwinds.observes Olivia.Whale movements (306 BTC after 12 years) and sanctioned nations' mining activity underscore BTC's enduring appeal.

Factors Influencing BTC’s Price

Crypto Market Crash Despite Bullish SEC News: What to Expect Next?

Bitcoin plunged to $114,000 hours after the SEC unveiled "Project Crypto," a regulatory framework signaling long-term institutional acceptance. The sell-off reflects macroeconomic jitters—core inflation hit 2.8%, Trump-era tariffs resurfaced, and revised jobs data revealed 250,000 fewer positions than initially reported. These factors complicate the Fed's path to rate cuts, spooking traders.

On-chain metrics suggest accumulation by long-term holders continues unabated. The SEC's move—while triggering short-term volatility—effectively greenlights institutional participation. This dichotomy between price action and fundamentals mirrors early-stage gold market adoption, where regulatory clarity preceded price discovery.

Synonym Launches Pubky, a Decentralized Web Protocol Challenging Nostr

Synonym, a trailblazer in decentralized technologies, has unveiled Pubky—a new protocol and social platform currently in beta. The system replaces traditional user accounts with cryptographic public keys, granting users full control over their digital identities without reliance on centralized intermediaries.

Pubky leverages PKARR, Mainline DHT, and homeservers to ensure content portability and verifiability. Its standout feature, Public Key Domains (PKDs), offers a censorship-resistant alternative to DNS, safeguarding user sovereignty even against server-level bans.

John Carvalho, Synonym's CEO, has openly criticized Nostr—a competing protocol favored by Bitcoin enthusiasts—highlighting its design flaws. Pubky aims to address these shortcomings while pushing the boundaries of decentralized social media.

Matrixport and DDC Enterprise Forge Alliance for Enhanced Bitcoin Custody

Matrixport, a leading crypto financial services provider, has partnered with DDC Enterprise Limited to strengthen institutional Bitcoin custody solutions. The collaboration will integrate Matrixport's regulated Cactus Custody platform into DDC's custodian network, offering enhanced security and compliance for corporate Bitcoin holdings.

DDC Enterprise, known for its corporate Bitcoin acquisition strategies, will leverage Cactus Custody's institutional-grade infrastructure to safeguard its growing Bitcoin treasury. The move signals growing institutional demand for robust digital asset custody solutions as Bitcoin adoption accelerates.

John Ge, CEO of Matrixport, emphasized the strategic importance of supporting DDC's pioneering role in Bitcoin treasury management. The partnership reflects the maturation of custody infrastructure as Bitcoin establishes itself as a core reserve asset for corporations.

Crypto-Backed Loans Gain Ground: What Homeowners Need to Know in 2025

Decentralized finance is maturing, and homeowners are increasingly leveraging their digital assets to secure loans without selling property or Bitcoin. A 2024 Chainalysis survey revealed that nearly 20% of global crypto holders have explored borrowing against their holdings, signaling a broader integration of blockchain assets into mainstream finance.

Crypto-backed loans allow borrowers to pledge coins like BTC as collateral for fiat or stablecoins, often requiring overcollateralization due to market volatility. Lenders retain control of the collateral only if payments default or values dip below agreed thresholds. The appeal lies in accessing liquidity without triggering taxable events from asset sales.

Hybrid lending platforms now combine traditional home equity with crypto collateral, preserving property deeds while unlocking value. This model is gaining traction among asset holders seeking liquidity without divesting positions—a quiet revolution in personal finance infrastructure.

Michael Saylor Launches Bitcoin-Backed Yield Product for Retirees

Michael Saylor, executive chairman of MicroStrategy, now rebranded as Strategy, has unveiled a novel income product targeting retirees—Bitcoin-backed preferred stock. Dubbed STRC, the offering promises a 9.5% yield, significantly outpacing traditional retirement accounts and savings vehicles.

The perpetual preferred security, which trades on the NASDAQ, provides monthly dividends backed by Strategy's substantial Bitcoin holdings. The firm currently holds 628,791 BTC, valued at over $74 billion, with recent price surges contributing to quarterly profits of $10 billion.

Saylor positions STRC as a high-yield alternative to money market funds, emphasizing its daily liquidity and lack of long-term lockups. "This is interesting for retirees," he remarked during Strategy's earnings call, highlighting its appeal for investors seeking steady returns in a low-yield environment.

Bitcoin Drops Amid Weak U.S. Jobs Data as Fed Rate Cut Odds Surge

Bitcoin tumbled despite a soft U.S. jobs report that should have buoyed risk assets. July's nonfarm payrolls added just 73,000 jobs—far below expectations—while downward revisions erased 258,000 positions from prior months. The data marks the weakest three-month stretch since 2020.

Treasury yields cratered as traders priced in a 75% chance of a September Fed rate cut. Gold rallied 1.5%, but crypto and tech stocks bucked the trend. Bitcoin slid alongside a 2.5% Nasdaq plunge. Coinbase cratered 18% post-earnings, while Bitcoin miner Riot Platforms lost 17%.

Market sentiment splits between two narratives: weak data fuels hopes for dovish policy, yet recession fears overshadow earnings outlooks. As The Kobeissi Letter noted, the jobs report either signals impending labor market weakness or flawed data—neither scenario inspires confidence.

Bitcoin Holds $112K Support as 96% of Supply in Profit, Eyes $130K Breakout

Bitcoin retests the $112,000–$115,000 zone, viewed by traders as a critical reload area before a potential move toward $130,000. With 96% of the BTC supply currently in profit, market sentiment remains strong, though caution lingers over possible profit-taking.

Technical consolidation at $114,000 is considered healthy by analysts, potentially setting the stage for a breakout. The cryptocurrency is trading at $114,069, down 3.14% in the last 24 hours, as it stabilizes above the $112,500 support level.

According to trader Merlijn, the $112,500 level serves as a structurally significant reload zone for bulls. This area could act as a launchpad for the next leg higher, with resistance levels often favored by savvy investors.

Sanctioned Nations Secretly Mining Bitcoin as Alternative Revenue Stream

Sanctioned nations are increasingly turning to Bitcoin mining as a covert revenue stream amid U.S. financial restrictions, according to HIVE Digital co-founder Frank Holmes. Recent hash rate fluctuations suggest Iran's military may be diverting energy resources to mine BTC following strikes on power infrastructure.

The trend extends beyond Iran, with multiple blacklisted governments leveraging crypto mining to bypass traditional financial systems. Bitcoin has emerged as a strategic asset for nations struggling with dollar access, providing direct value accumulation outside conventional channels.

HIVE Digital is expanding operations in U.S.-aligned territories like Paraguay, even as adversarial states weaponize mining infrastructure. Network data now reveals geopolitical disruptions through measurable changes in computational power.

Ancient Bitcoin Whale Moves 306 BTC After 12-Year Dormancy

A dormant Bitcoin wallet holding 306 BTC since 2013 was emptied on Friday as prices dipped to three-week lows. The coins, originally worth approximately $75 each during the Silk Road era, now represent a $34.8 million windfall—a 152,300% appreciation.

This movement follows a pattern of long-term holders capitalizing on Bitcoin's recent rally. Two weeks prior, Galaxy Digital processed a $9 billion sale for a client involving 80,000 BTC from another ancient address. The market continues to see sporadic activations of decade-old wallets, including a 50 BTC transfer from 2010 worth $5 million in April.

Tether Posts Record $4.9B Q2 Profit Driven by Bitcoin and Gold Holdings

Tether's USDT stablecoin empire delivered staggering quarterly results, with net profits surging 277% year-over-year to $4.9 billion. The windfall came from a trifecta of assets: Bitcoin positions, gold reserves, and US Treasury holdings.

The stablecoin issuer's market dominance grew in lockstep with its profits. USDT's circulating supply ballooned to $157 billion—a $13 billion quarterly increase—as traders and DeFi platforms continued adopting the dollar-pegged asset as their liquidity vehicle of choice.

Behind the scenes, Tether maintained a disciplined reserve strategy. Nearly 81% of its $127 billion in assets sat in ultra-safe US government securities, while mark-to-market gains on its Bitcoin and gold positions delivered $2.6 billion in unrealized profits.

Canaan Inc. Adopts Bitcoin as Primary Reserve Asset in Strategic Pivot

Canaan Inc. (NASDAQ: CAN), a leading crypto mining firm, has formally designated Bitcoin as its core reserve asset under a newly implemented Cryptocurrency Holding Policy. The Nasdaq-listed company will retain BTC accumulated through self-mining and equipment sales unless liquidity needs or risk management require divestment.

As of June 30, 2025, Canaan's treasury holds 1,484 BTC—a position Chairman Nangeng Zhang describes as foundational to the company's capital strategy. "This policy anchors our role in the global Bitcoin ecosystem," Zhang stated, framing the move as both a balance sheet fortification and a long-term bet on digital asset adoption.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and macroeconomic factors, BTCC's Olivia provides these projections:

| Year | Conservative Target | Bullish Target | Catalysts |

|---|---|---|---|

| 2025 | 130,000 USDT | 180,000 USDT | ETF inflows, halving aftermath |

| 2030 | 500,000 USDT | 1,200,000 USDT | Global reserve asset status |

| 2035 | 2,500,000 USDT | 5,000,000 USDT | Mass adoption as collateral |

| 2040 | 8,000,000 USDT | 15,000,000 USDT | Network effect dominance |

Key risks: Regulatory shifts, quantum computing advances, and CBDC competition could alter trajectories.

border-collapse: collapse; width: 100%; margin: 20px 0;